How to define Balance limits for a customer.

Overview

Balance limits can be defined per customer, to deny customers with high negative balance to process new orders or subscribe to provisioning. These limits are set per currency. There are two types of limits:

- Maximum debt overall – defines limit for all unpaid invoices on a customer’s account.

- Maximum debt past due date – defines limit for unpaid invoices which have passed due date.

Setting balance limits for customers

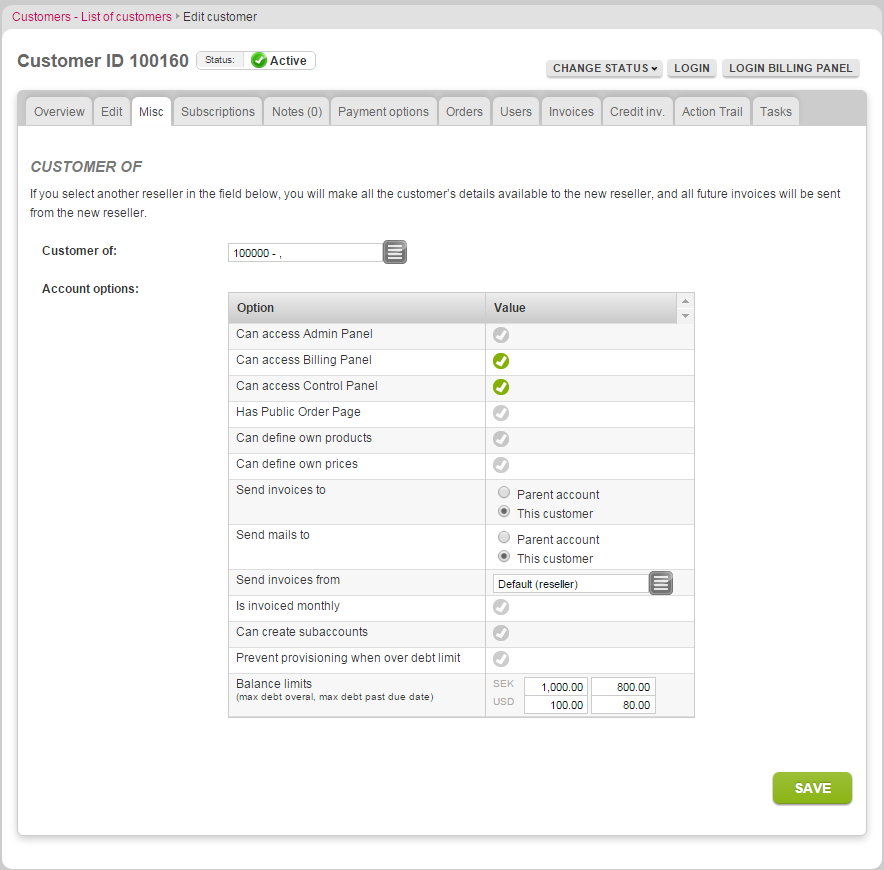

These limits can be set for a customer on the Misc tab of his/her Card, but it can be also done for a reseller as a part of Subaccount defaults. If it is part of a reseller’s configuration for subaccount defaults, all new customers will have the same limits when they are created.

Image 1: Setting limits for a customer.

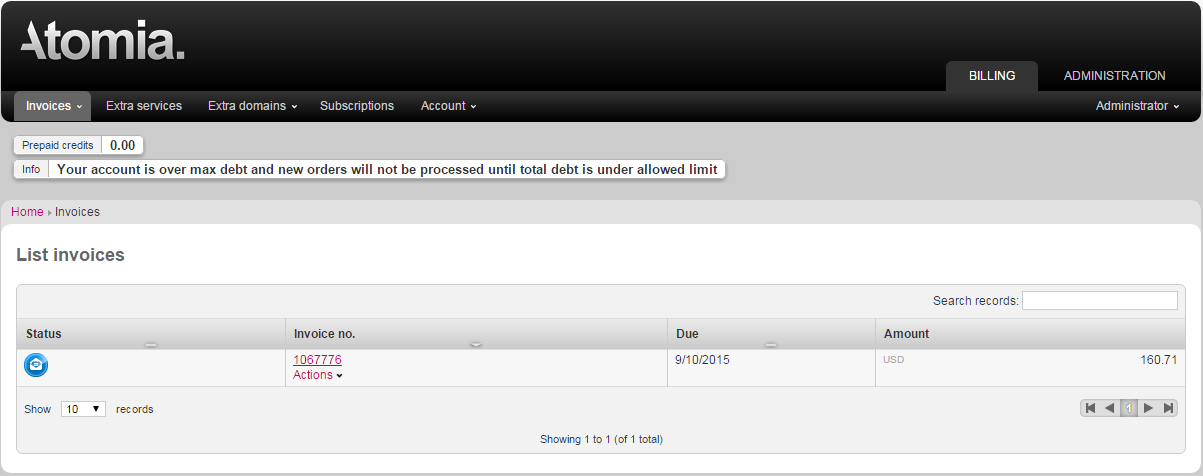

When a customer is over the debt limit, a message on his/her Card in the Admin Panel will be displayed. Also, similar warning will be displayed to the customer in the User Panel. This will prevent provisioning of new subscriptions and all new orders will be put on hold with status CustomerOverDebtLimit. Their processing will not be possible until the customer pays invoices and his/her balance is within limits. When that happens, a task of type PROCESS_PENDING_ORDERS will be scheduled to process all pending orders. With every new order, balance will be recalculated and processing will be stopped if customer goes again over debt limit.

Image 2: A warning message is displayed in User Panel if the customer passes the debt limit.